This post is sponsored by MetLife Auto & Home®.

I started this blog in 2007 as Brandon and I were about to move into our first house. Before that, I had loved decorating our apartment (even if I didn’t have an online outlet to publish everything to — imagine!). I painted and repainted, added window treatments, and thought over every little detail to make our apartment into a home we loved.

I know I wasn’t thinking about renters insurance back then though, and that’s not uncommon. Had anything happened, our landlord’s insurance would have only covered the property — not our personal belongings.

We’re insured now of course, but I should have been more aware of the importance when we were in the apartment too. If there were a fire, or had our possessions been stolen or vandalized in a break-in, renters insurance could have helped replace what was lost.

Cutting edge insurers like MetLife Auto & Home are now making it convenient for renters to access needed insurance online. For example, MetLife Auto & Home® makes it easy to get an instant quote online. From there you can go ahead and purchase your policy for instant coverage, all online. MetLife Auto & Home is rolling this out state by state; you can enter your zip code to see if it’s available in your area. It’s quick, it’s super convenient for busy people (read: everyone), and it checks an important item off your to-do list.

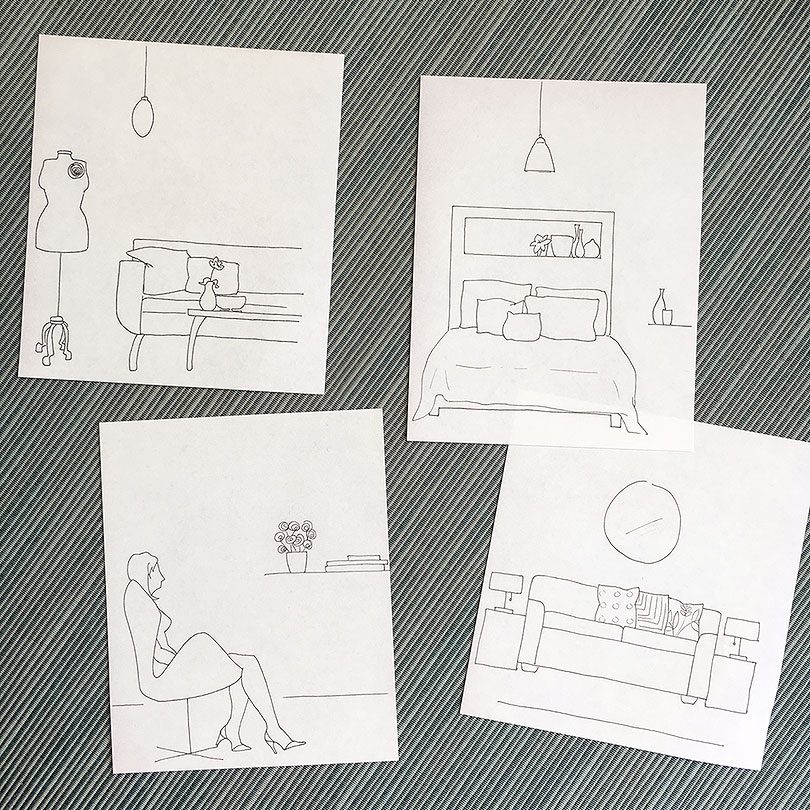

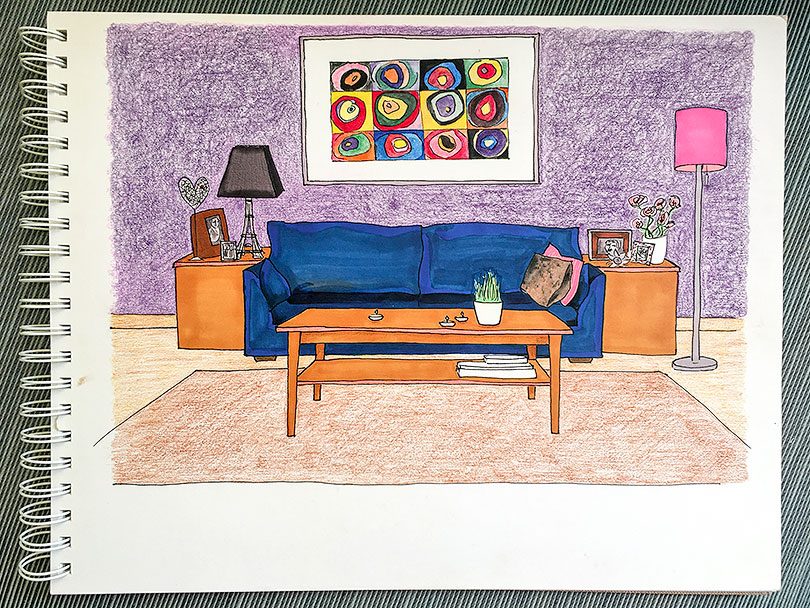

I used to sit and sketch new ideas for our place. I still have a lot of those old drawings.

(Who else had that Kandinsky print from IKEA? Show of hands!)

I remember how excited Brandon and I were to move into a nicer apartment than the one we had started in. I wanted to make sure everything was just so, and drawing was my way of testing out new ideas. We were also navigating our way through a new phase of life, figuring out the whole ‘adulting’ thing. Renters insurance should have been a part of that.

House or apartment, we work to make our homes beautiful — we need to also make sure they’re protected. Homeowners, I’ve no doubt you’re aware of the need for home insurance. Renters? Be smarter than I was! Now with homeowners and renters insurance available from a few companies online, consumers can get quotes and policies from providers like MetLife Auto & Home® and they can get covered. There may be states where the products are not available, but you can find all that information directly from the carrier once you’re at the portal. MetLife Auto & Home has made it really simple for users.

Mandolin

November 7, 2017 at 11:14 amI am a renter and I have noticed in the last maybe 5-6 years that landlords and rental companies are now requiring proof of renters insurance before you can even move into your apartment. I have lived all over the country and it’s been required in each place (Kansas City, Atlanta, Colorado Springs, OKC) we’ve lived. Our renters insurance also covers items in our car that might be stolen but aren’t covered by our car insurance policy, which is a nice bonus. I was surprised by how cheap a lot of coverage can be. This is one of those things that you don’t think you need, until you do.

Making it Lovely

November 10, 2017 at 9:13 amExactly. I’m so glad we didn’t find out the hard way.

shyam

November 17, 2017 at 4:42 amI really appreciate if you could share some content on tips on placing TV Units In your home.